NEWS & INSIGHTS

News - March, 2021

European Growth PE is a booming segment in Europe’s private equity market. With scale comes specialization and the emergence of different investment strategies.

European Growth PE is maturing and a segmentation has emerged

European Growth PE exists at the intersection of venture capital and traditional private equity. It combines organic value appreciation and fast growth as typically seen in venture capital with a degree of scale and stability more common in traditional private equity. Today, European Growth PE funds account for 17% of overall annual European private equity fundraising, compared to 5% only five years ago. European Growth PE is clearly emerging as a third, strong private equity investment strategy between the venture capital and the buyout business.

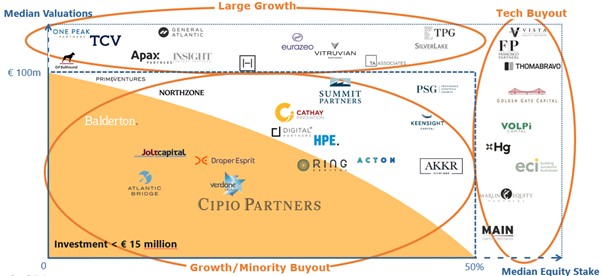

The scale of the growth market allows players to find ample opportunity even in its subsegments. Actors in the market have different preferences, resources and capabilities. This reflects their particular positioning in the overall market.

Two vectors are most important:

The first vector is the preference for control vs. non-control investments. Some investors are philosophically control investors and want to own at least 51% of a company in order to call the shots. Other investors prefer syndicated transactions, work collaboratively with entrepreneurs and prefer minority positions in their portfolio companies.

The second vector is the valuation range at which investors tend to get involved. Given respective fund sizes and target ownership stakes, investors target broad ranges of valuation that suit their investment strategy. €100 million seems to be a frontier that divides the market.