NEWS & INSIGHTS

News - November, 2020

The pandemic has made technology the new safe haven for investment. Growth Equity is booming and within it secondary transactions may become more prevalent.

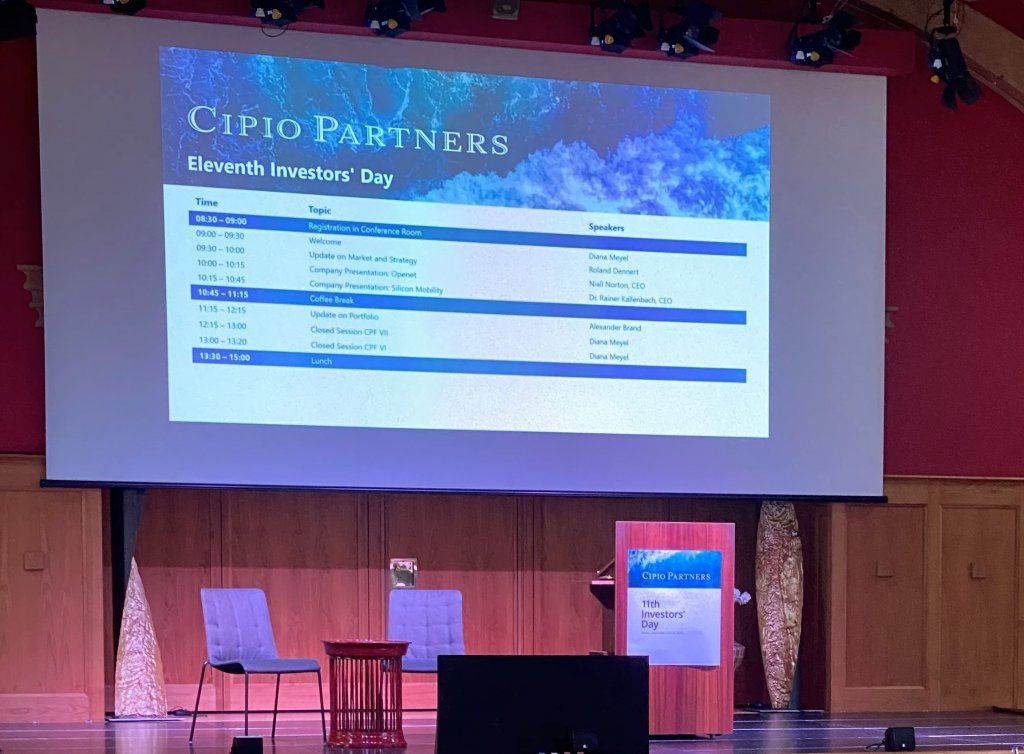

These were some conclusions when, in September 2020, we were privileged to spend 1.5 days off-site and in person with many of our limited partners. One inevitable topic was how the pandemic has changed technology investing.

The pandemic has made technology the new safe haven for investment

The global economy is in what could well become the deepest recession of our lifetime. The lock downs around the world in the first half of the year have slowed the economy in most countries by typically 10–20% and for the full year we are anticipating several percentage points GDP decline for the global economy. This recession is significantly more severe than the Global Financial Crisis or anything else that we have seen in our lifetime.

But not all sectors of the economy are affected equally. Analyzing the impact of the pandemic on total shareholder return in specific industries the Boston Consulting Group has shown that many sectors are hit very hard, but technology, biopharma and med-tech have benefitted.

So why is technology doing so well in the current environment? Our behavioral changes are the reason. We shop online instead of going to the High Street. We buy Pelotons and fitness apps and cancel the fitness studio. We order food online and avoid going to the restaurants. Business behavior changes as well. We do Zooms instead of travelling to meetings. We collaborate in software not in meeting rooms. Companies buy software and upgrade their IT infrastructure to increase work force efficiency and enable remote work. The transformation of our society from the physical, analog world to a virtual, digital world is accelerated by the pandemic. Technology companies are benefitting from this transformation.

Since technology companies seem to benefit despite the severe recession, they are becoming the new safe place for capital. Liquidity is abundant and technology assets is where it goes. Overall European Stocks are down for the year, but technology stocks have risen significantly. Technology giants such as Apple, Google or Tesla have reached record valuations.

What holds true for public markets also holds true for private markets: Fundraising for European technology funds has been strong for the first half of 2020 and it seems that the second half of the year is no different.

Technology assets, both public and private, are the new safe haven for capital in an uncertain world.